⬜ Sales Returns in AurPOS

Sales Returns in AurPOS are used when a customer returns a previously purchased item. The system allows you to adjust returned quantities and handle related processes easily, with automatic updates to inventory and reports.

✅ What is a Sales Return?

A sales return is a process used to return one or more items from an existing sales invoice. It directly affects inventory and financial reports.

✨ Important Note:

A sales return does not directly affect the payments associated with the original invoice. Instead, it is recorded as an independent transaction as follows:

-

To view return details: The return is listed in the Sales Returns section, linked to the original invoice without affecting its payment status.

-

To view the total return amount: The impact of the return appears in reports such as Profit and Loss or Purchases and Sales, helping you track the total returned value.

✅ Methods for Processing a Sales Return

You can process returns in two ways:

1️⃣ Method (Recommended):

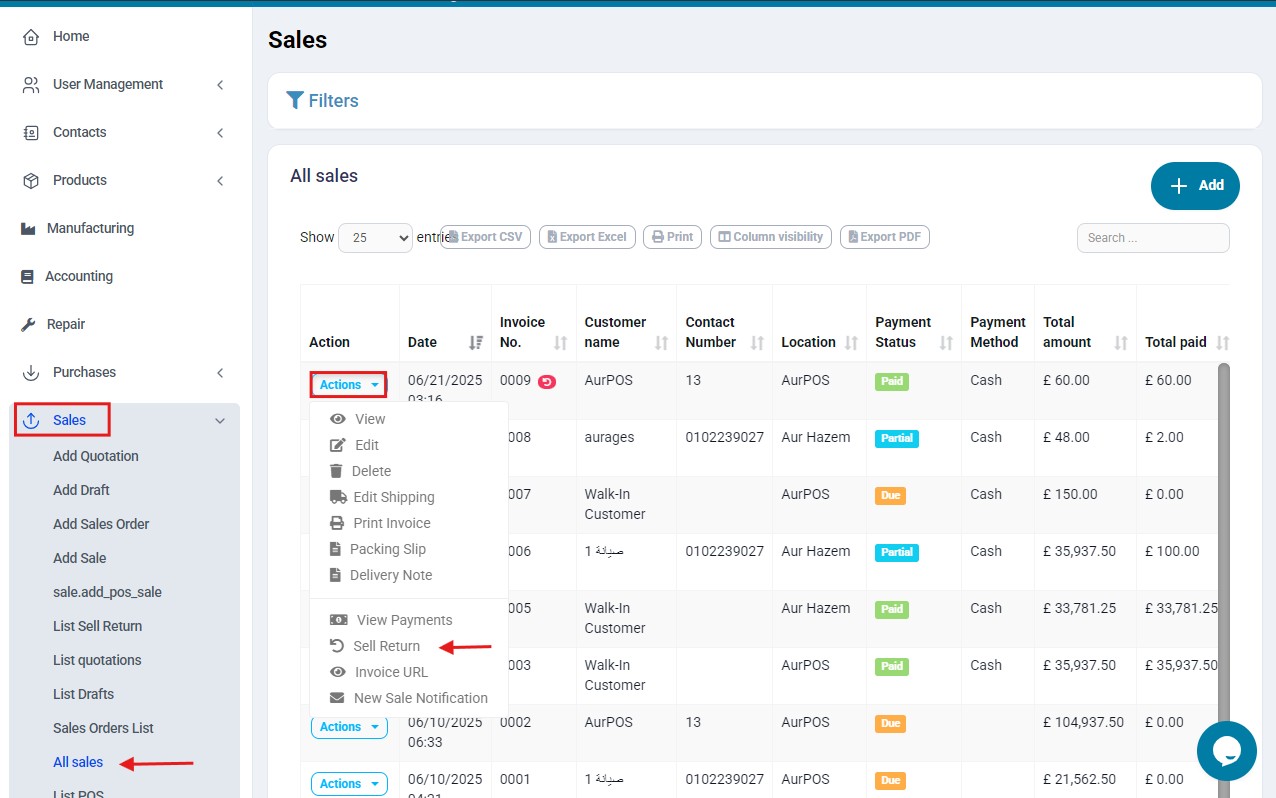

➤ Go to Sales → All Sales

➤ Locate the invoice you want to adjust

➤ Click Edit Invoice from the options

➤ Reduce the quantity of the item or remove it

➤ Click Save

✔ The inventory will be updated automatically.

2️⃣ Method :

Use the direct Add Sales Return option from the Sales Returns menu:

➤ Go to Sales → All Sales

➤ Select the original invoice

➤ Click on Actions → Sales Return

➤ Choose the items and quantities to return

➤ Click Save

✔ The return will be recorded, and the quantities will be added back to inventory automatically,and it will appear automatically in the Sales Return list.

✅ Sales Returns List

To view all previous returns:

➤ Go to Sales → List Sales Returns

From this menu, you can:

-

Browse returns by date or customer

-

Review the return details linked to each invoice

-

Print or export return records

-

Edit or delete a return (if needed)

✅ Important Note on Payments and Returns:

Why isn’t the return amount automatically deducted from the original invoice payment?

To ensure accurate financial records:

-

AurPOS processes the return as a separate adjustment visible in the Profit and Loss report

-

The user must manually record the payment transaction to the customer (if applicable) by adding a payment transaction

➕ This ensures all cash operations are clearly and accurately documented in the reports.

✳️ Tip:

Using the Sales Returns feature helps you track returned items, update inventory, and maintain accurate accounting reports without directly affecting original invoices.

العربية

العربية