⬜ Cash Flow in AurPOS

The Cash Flow section in AurPOS provides a vital tool for monitoring the movement of money within your business. It offers a detailed overview of all incoming and outgoing financial transactions, allowing you to evaluate your actual liquidity over a specific period.

This tool is designed to be user-friendly and highly effective for review purposes, helping business owners and accountants make informed decisions based on real cash activity.

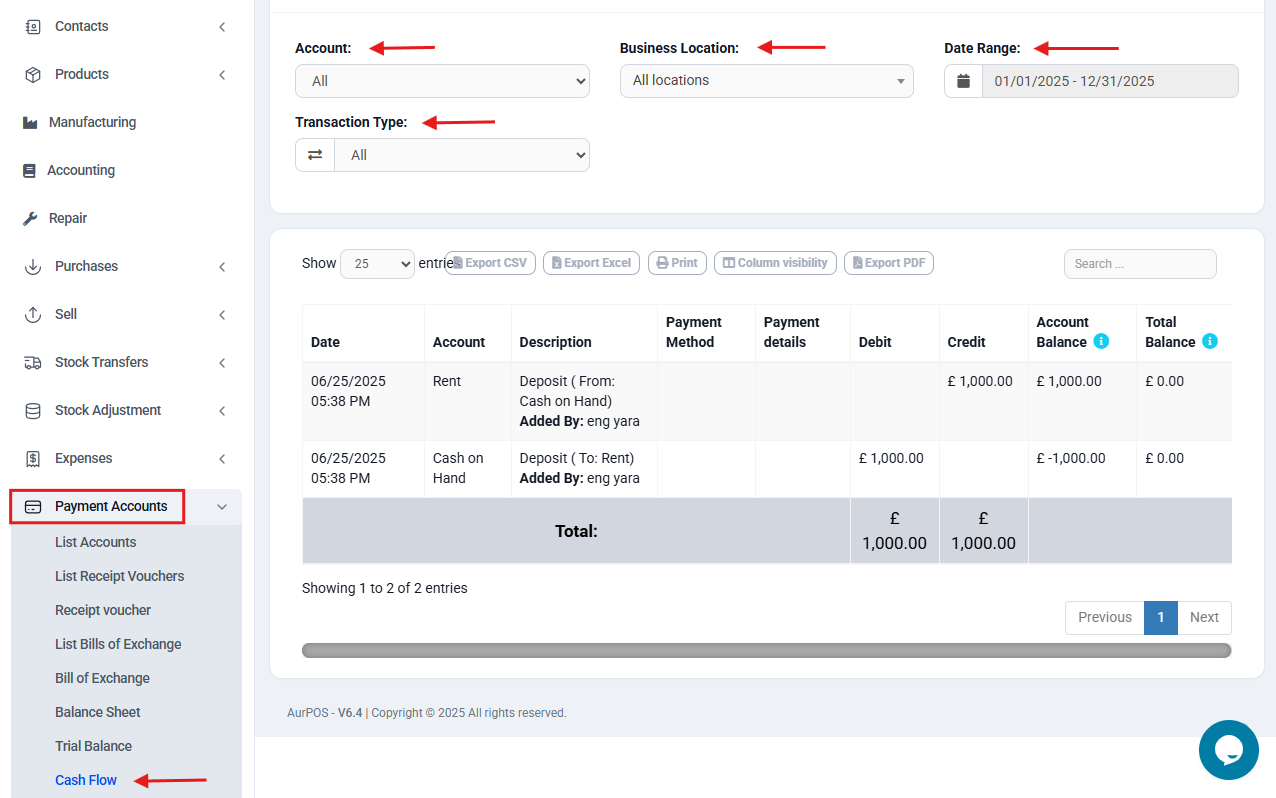

✅ How to Access the Cash Flow Section?

From the side menu, go to:

Accounts → Cash Flow

✅ What is the Cash Flow Report?

The Cash Flow report displays all cash transactions recorded in the system—whether expenses or revenues—based on a date range you define.

This report helps you understand:

-

Where the money came from

-

Where it went

-

What the remaining balance is

✅ What Does the Cash Flow Report Show?

Once you apply filters such as date, branch, and transaction type, the system displays a detailed list that includes:

-

Transaction date

-

Account type (e.g., Payables, Rent, Customers, Suppliers)

-

Transaction description (e.g., Expense, Deposit, Payment)

-

Payment method (Cash, Bank Transfer, Cheque, etc.)

-

Payment details (including reference numbers)

-

Debit amount

-

Credit amount

-

Account balance after the transaction

-

Total cumulative balance

✅ Available Filters:

-

Accounts: Select a specific account or view all accounts.

-

Business Location: Filter transactions by a particular Location.

-

Date range: Choose the financial period you want to review.

- Transaction type: Focus on a specific type (e.g., only expenses or only income).

⭐ Why is the Cash Flow Report Important?

-

It reveals the actual cash liquidity available in your business.

-

Helps in financial planning based on real figures, not just accounting entries.

-

Highlights periods of cash surplus or shortage, enabling proactive decisions.

-

A key tool for accurately tracking daily obligations and payments.

In short, the Cash Flow report is one of the most important financial reports in AurPOS. It gives you a real-time view of your money's movement, making your financial decisions smarter and more confident.

العربية

العربية